Living Your Best Life with a Reverse Mortgage

Senior Citizen homeowners are able to live financially happier and more relaxed when they consider getting a reverse mortgage. Learn more about qualifying and what you need to know…

Senior Citizen homeowners are able to live financially happier and more relaxed when they consider getting a reverse mortgage. Learn more about qualifying and what you need to know…

As we age in place and want to stay in our home, it will be necessary to do some modifications to the home like wider doorways. Here are some popular upgrades to your home for you to stay at home

Here are some reminders of common investment mistakes retirees make.

Survey: 64% of Americans were expected to retire broke. Survey: Only 38.1% were saving specifically for the cost of health care in retirement. Average retiree is thought to spend $4,300 on health care each year, although specific conditions and treatments can certainly affect this amount. Only 20.9% of people earning less than $50,000 said they believed they would have sufficient savings for retirement. Nearly 23% planned to use a health savings account (HSA) – or tax-advantaged account – a relatively more effective option than a personal savings account.

Seven total retirement income strategies will be considered, six of which involve spending from a HECM(Reverse Mortgage)

Money Magazine’s discussion of the Pros & Cons of reverse mortgages… know completely what you give up when getting the reward of this senior loan for homeowners.

Common questions answered on the reverse mortgage… like the misconception that it is only a loan against the property and the lender is taking your house.

Our Promise to tell you the details at a speed you are comfortable and show you your options.

Why the reverse mortgage might be the perfect loan in retirement…

HECM’s(reverse mortgages) are a remarkable consideration for financial advisors to guide senior homeowners with options in retirement.

Is retirement as rich and rewarding as you thought? Senior citizen homeowners with equity can do a quick exercise to see how much tax-free money a reverse mortgage might offer. A chart of your age & house value guides you also…

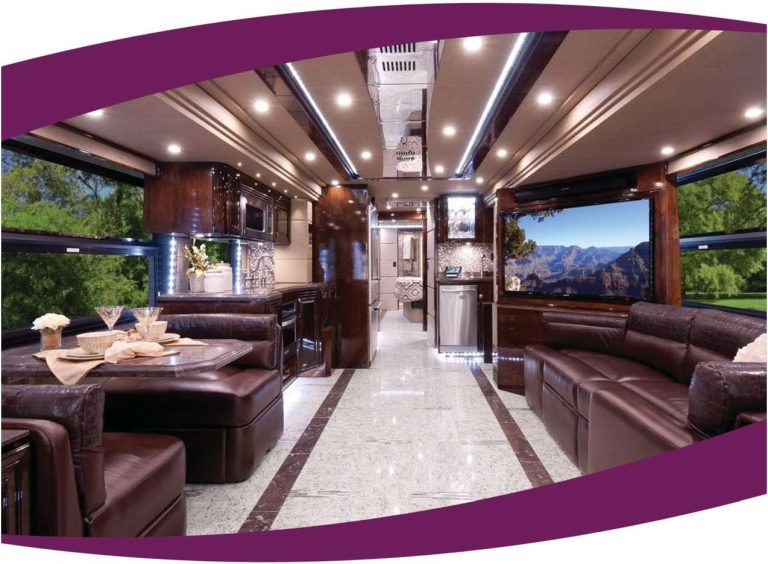

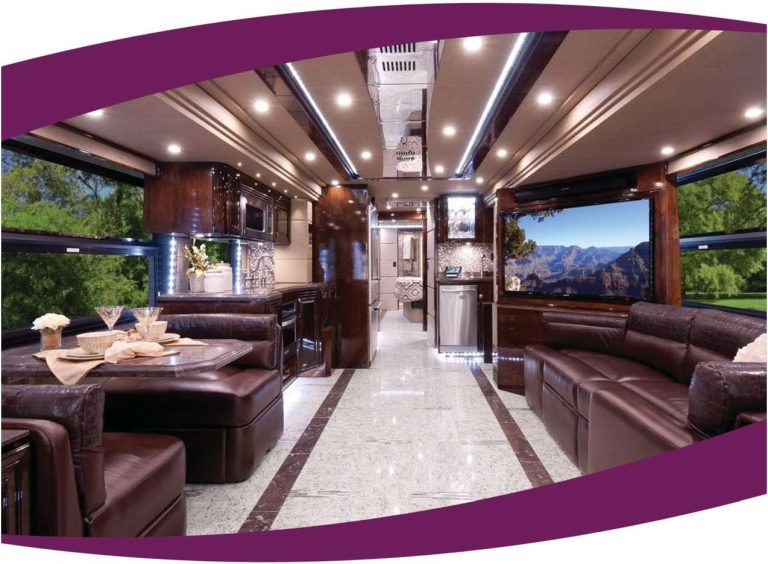

A Reverse Mortgage can help you travel! Release the equity in your home for cash to maybe buy an RV? Use the chart to see how much cash might be available based upon your age & house value…

HECM(reverse mortgages) offer senior citizen homeowners a way to eliminate their mortgage, get a lump sum, credit line or even monthly income of tax free cash.

Reverse mortgage steps to success when you apply for this loan from the equity in your home.

Reverse Mortgage offers quality of life in retirement. Facts & Repayment are discussed…

Reverse Mortgage Myths discussed with Truth’s revealed…

Reverse Mortgages offer many options for senior citizen homeowners to solve many financial problems…