Aging and Retirement

MANAGING POST-RETIREMENT RISKS: Strategies for a Secure Retirement

Contents

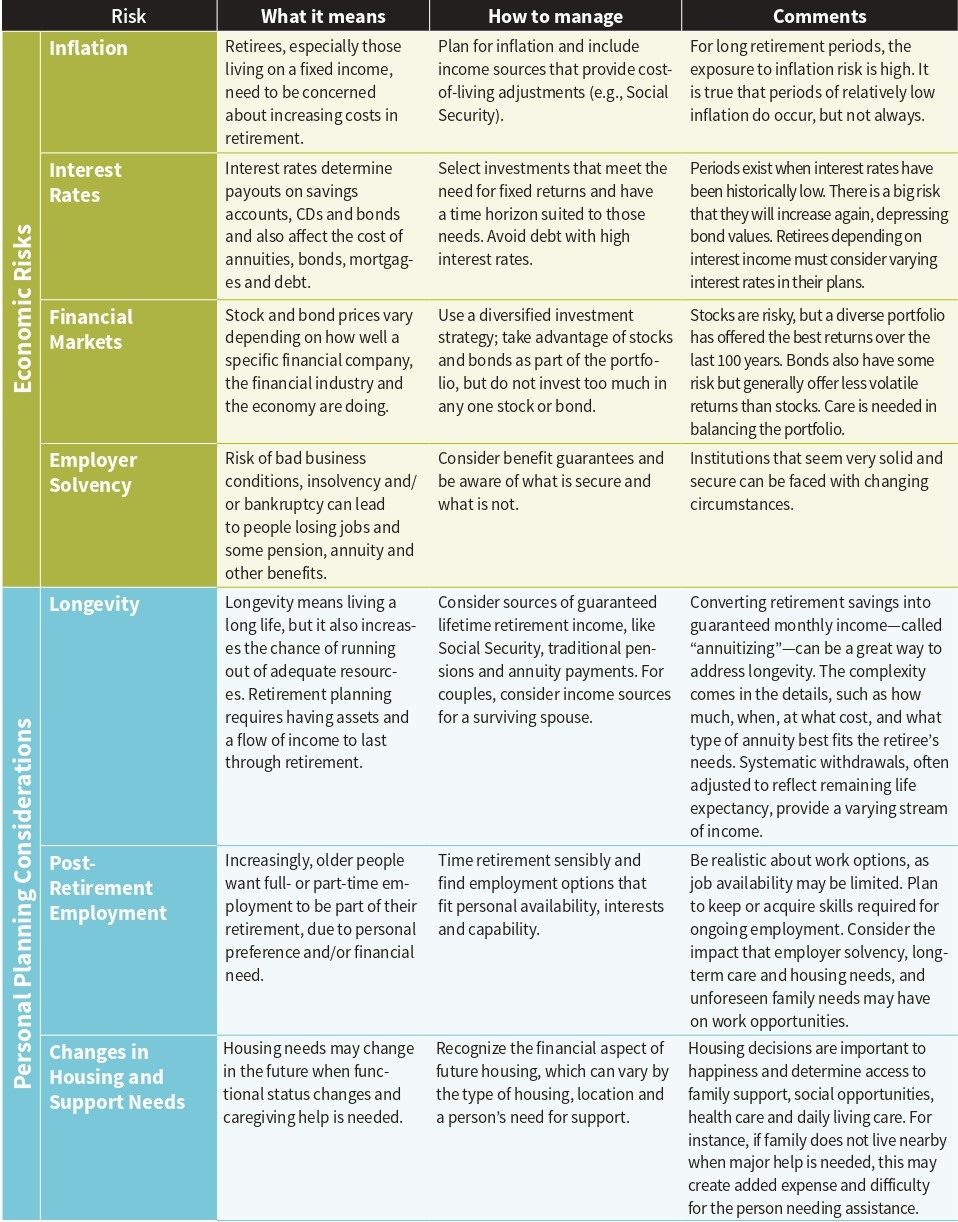

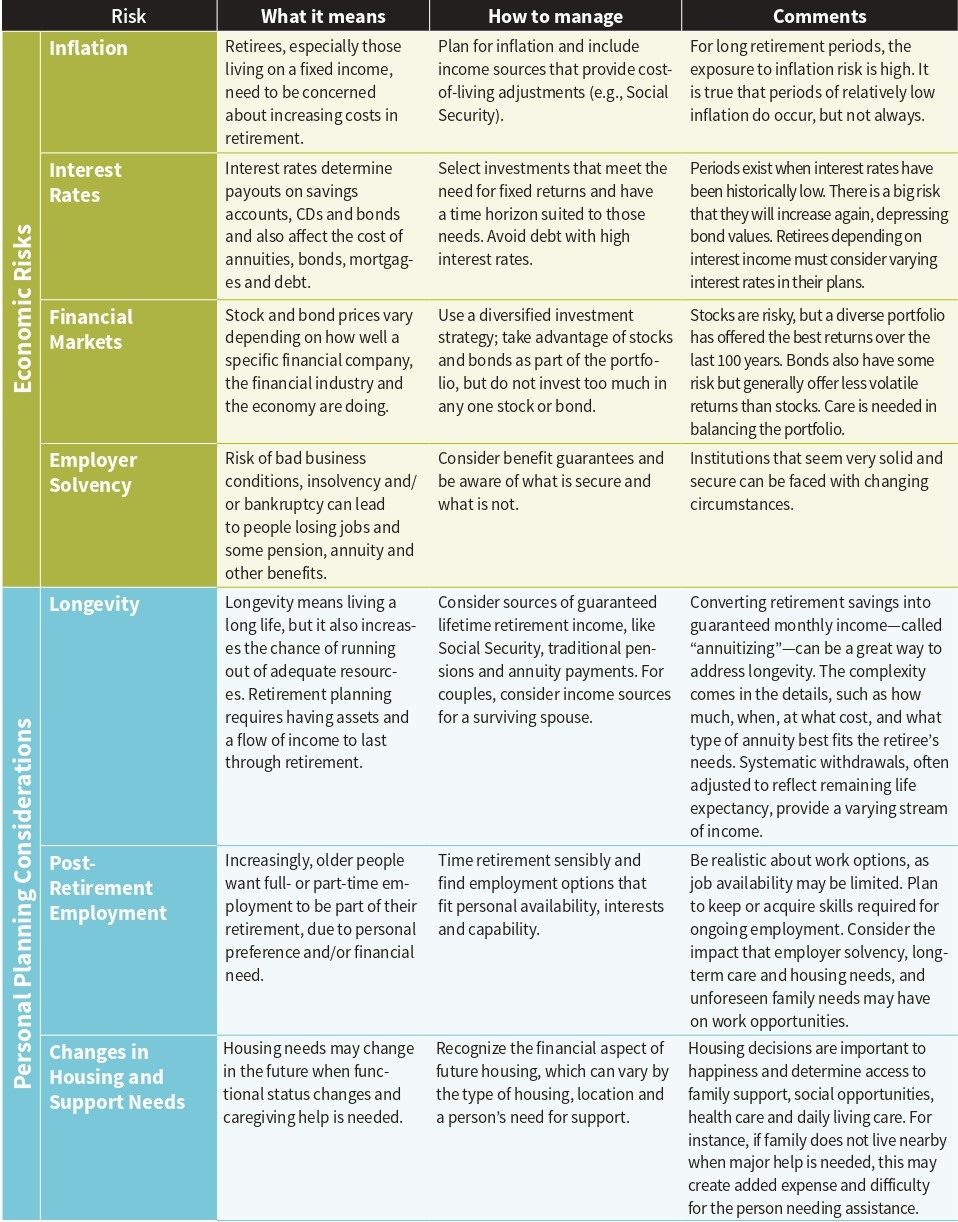

2020 Retirement Risk Chart – Secure Retirement

Economic Risks

- Inflation: Losing Purchasing Power

- Interest Rates: Different Effects On Income And Assets

- Financial Markets: How Ups And Downs In The Economy Influence Outcomes

- Employer Solvency: Issues With Certainty Of Income

Personal Planning Considerations

- Longevity: Potential Of Living Longer Than Expected

- Post-Retirement Employment: The Gradual Move To Full Retirement

- Changes In Housing And Support Needs: Suitability And Affordability

- Change In Marital Or Partnership Status: Death Of Spouse Or Partner

- Change In Marital Or Partnership Status: Divorce Or Separation In Retirement

Unexpected (or Unpredictable) Events

- Public Policy Changes

- Significant Health Care Needs

- Unforeseen Needs Of Family Members

- Bad Advice, Fraud Or Theft

Related Planning Issues

References

Managing Post-Retirement Risks: Strategies for a Secure Retirement

Recent history has seen not only economic uncertainty and volatility but also an increased emphasis on individuals taking responsibility for securing their financial well-being in retirement. As a result, today’s retirees may be expose to a variety of post-retirement risks that can affect them both as individuals and as members of society.

In view of this, the Society of Actuaries (SOA) continues to work to raise awareness of post-retirement challenges and to explore ways to help people become aware and address them. Part of this ongoing effort has been to create a Retirement Risk Chart to provide information to the general public about retirement risks.

Written in everyday language, the chart details the many risks that individuals may face in retirement. Examples include risks associated with longevity, investments, health, fraud and loss of loved ones. Strategies for managing risk in retirement are highlight, so readers can start to recognize and plan for the risks they face and recognize the trade-offs that may be involve.

The 2020 Retirement Risk Chart is the fourth edition. Originally published in 2003, this dynamic chart has been update and expand to provide more information and reflect new developments in retirement planning. The 2020 edition has been reformate to provide an overview of many types of risks, followed by additional detail.

The SOA encourages use of this chart as an educational tool for exploring retirement needs, plans and options. Combining the knowledge gleaned from the chart with other planning information and guidance can result in better- informed decision-making, more effective retirement planning, and a more rewarding retirement. The information found here is not intended to be financial, legal or tax advice.

Individuals face many risks in retirement. Most people can plan for some of the risks, but others might be unexpected. The chart on the following pages divides retirement risks into three categories: economic risks, personal planning considerations, and unexpected (or unpredictable) risks. Following the chart are fact sheets with more information on each risk and some other related planning issues.

Note: This material was prepare by a task force of retirement planning experts. The views and opinions express are those of individual task force members and do not represent an official statement or position on behalf of the Society of Actuaries or any organization with which they are affiliate. This chart is not intend to provide advice for specific individual situations and should not be construe to do so under any circumstances. It has been create as an educational tool to provide general guidance. Individuals in need of advice for specific situations should seek the services of a qualified professional.

Copyright © 2020 by the Society of Actuaries. All rights reserved.

2020 Retirement Risk Chart for Secure Retirement

The following pages provide more detail on each of these risks as well as some related planning issues and references.

Economic Risks

INFLATION: LOSING PURCHASING POWER

BACKGROUND

Inflation is generally viewed as an ongoing concern for anyone living on a fixed income. Inflation affects the level of prices a retiree pays for goods and services. High inflation with increasing prices requires retirees to spend more of their retirement resources for goods and services than during low inflation periods. While investments in bonds and interest-related funds may produce higher income, the result of rising prices may be greater than the increase in income during high inflationary periods.

In periods of relatively low inflation, workers may not know about or remember the impact of the double-digit inflation of 1947, 1974 or 1979–81. Even low rates of inflation can seriously erode the value of fixed retirement benefits over time and thereby the well-being of retirees who live many years.

Medical costs, especially prescription drugs, often increase faster than general inflation. In addition, the retirees’ share of medical costs, including premiums for Medicare and Medigap policies, often increases more rapidly than average medical costs. As a result, inflation can become a bigger issue for some retirees than would be expect based on average inflation rates.

Some sources of retirement income, like Social Security and other government retirement programs, pay benefits that provide some inflation protection, but most private pension plans do not.

PREDICTABILITY

While past inflation rates can be a guide for estimating future inflation, the level of inflation can vary greatly. Over a long period of retirement, the possibility of high inflation increases. In addition, individual retirees’ actual experience can vary widely depending on factors such as where they live, their need for and use of medical services, and their spending preferences.

MANAGING THE RISK

Providing for expected inflation is a factor to be consider in any realistic plan for managing resources in retirement. Some strategies include:

Optimize inflation-protected sources of income: This is the first step of a strategy to address the risk of inflation. For people born after 1943, each year that they delay claiming their Social Security benefits, beyond full retirement age, will increase their Social Security benefit once they do make a claim. The increase will be 8% per year up until age 70. In many situations, it may be advantageous to delay receipt until age 70; doing so will help build up valuable inflation-indexed benefits for retirees and their surviving spouses. Coordinating the commencement of other pensions or the withdrawals from 401(k)s (defined contribution retirement accounts) or individual retirement accounts (IRAs) can optimize this strategy.

Plan for increased consumption over time: One strategy is to set aside assets to be use in the future when costs may be higher.

Invest in assets that have historically grown in value during times of inflation: Certain investments may provide greater protection against inflation in the long run, but their value can vary greatly in the short run, which can add uncertainty during retirement. For that reason, this strategy sometimes results in trading inflation risk for financial market risk. For instance, common stocks have increased more rapidly than consumer prices over the long run, and investments in natural resources and other commodities often rise in value during periods of long-term inflation. However, in the short term, returns can be very volatile and may not offer reliable protection against inflation. In addition, the historically higher returns are not guarantee for the future and can vary greatly during retirement years.

Invest in assets that incorporate inflation protection: Inflation-indexed Treasury bonds, such as Treasury Inflation Protected Securities (TIPS) and I Bonds, grow in value and provide more income as the Consumer Price Index (CPI) goes up. Many investment experts suggest that retirees consider including some of these securities in their portfolio.

Explore annuities with built-in inflation protection: These kinds of annuities cost more than fixed-payment annuities with the same initial level of income. (See box for examples.)

ADDITIONAL CONSIDERATIONS

Home values: When home values are increasing, homeowners seem to have a hedge against inflation. However, retirees who expect to use their home equity as a source of retirement income may be sorely disappoint, especially if home values decline.

Strategies that rely on increases in the value of the home and selling it to generate retirement income are very risky. That is because the value may not rise as hoped and it may take a long time to sell the house. In addition, replacement housing costs will have likely increased at the same time.

PRODUCTS

Types of annuities with built-in inflation protection:

- Inflation-index annuities adjust payments for inflation up to a specified annual limit; these are not yet widely use in the United States.

- Annuities with a predefined annual increase also are available.

INTEREST RATES: DIFFERENT EFFECTS ON INCOME AND ASSETS

BACKGROUND

Interest rate levels can be a major factor affecting income in retirement, since they affect the level of income retirees earn on their retirement resources.

Low interest rates produce lower income, so retirees must spend more of their retirement resources than during high interest rate periods. Higher interest rates usually mean higher inflation, so retiree income and expenses may increase at the same time.

Lower rates may mean lower inflation but can substantially reduce retirement income in several ways:

- Workers’ savings will not accumulate as rapidly; therefore, workers must save more or work longer to accumulate an adequate long-term retirement fund.

- Retirees earn less investment income on investments such as CDs and bonds and thereby have reduced spendable income, and any income reinvested earns lower returns.

- Payout annuities yield less income for a given lump-sum purchase price when long-term interest rates are lower versus higher at time of purchase.

PREDICTABILITY

Long-term and short-term interest rates can vary widely. Underlying forces that drive interest rates include expected inflation, government actions and business conditions.

MANAGING THE RISK

Lock in interest rates: Income annuities provide retirees with a guaranteed fixed income, despite changes in the interest rate environment. For that reason, prevailing interest rates at time of purchase will impact the amount of annuity payout the retiree can purchase with a given lump sum.

Consider longer-term investments: Investing in long-term bonds, mortgages or dividend-paying stocks can offer protection against the impact of lower interest rates, although the value of these investments will change with the change in interest rates. The risk is that rising interest rates will reduce the value of such assets available to meet needs. Individuals holding bonds may want to consider using methods (e.g., duration matching, bond ladders) that help manage interest rate risk. If needed, advisors can be consulte to explain and help construct such methods.

ADDITIONAL CONSIDERATIONS

Long-term interest rates often move up or down at about the same rate as inflation. If a retiree depends on interest- based investments for retirement income, a low interest rate environment often is more harmful to income than higher interest rate environments; this is so even though inflation also tends to be lower during low interest rate periods.

Higher real interest returns (i.e., the rate of return above the rate of inflation) usually make retirement more affordable. This occurs when retirees own high-yielding bonds, certificates of deposit, etc. and hold on to them during periods of lower inflation.

Long periods of low interest rates make it difficult for retirees relying on income from interest-bearing investments to manage on the reduced interest income.

Some retirees have adjustable-rate mortgages or substantial consumer debt with significantly higher interest rates than what they are earning on their savings. For such retirees, the higher interest rates that accompany increased inflation may reduce spendable income due to rising debt repayments; complicating matters is that this may happen just when more spendable income is needed.

It’s important to remember that when the interest rates earned on investments decline, the interest rates charged on some forms of debt, particularly credit card debt, may not decline.

FINANCIAL MARKETS: HOW UPS AND DOWNS IN THE ECONOMY INFLUENCE OUTCOMES

BACKGROUND

To invest in securities, retirees can and do purchase individual stocks or buy financial products—such as mutual funds, exchange-traded funds (ETFs) and variable annuities—that offer access to a portfolio of stocks. They may also own 401(k) and other defined contribution plan stock investment options that generally allow them to invest in a portfolio of stocks but may also provide for investment in company stock.

The stock market has generally outperformed other investments over time. For that reason, stock investments are recommended for retirees’ investments as part of a long-term investment mix. However, retirees need to remember that stock market values can fluctuate significantly over time and that stock market losses can seriously reduce retirement savings.

Particularly critical is the timing of potential stock market losses when retirees want to withdraw from savings or investments to generate retirement income. Sometimes they encounter what is called the “sequence of returns risk.” Sequence risk is the risk that the timing of withdrawals from a retirement account will require a larger portion of the account to be liquidate and have a negative impact on the overall rate of return available to the investor. Someone saving for retirement with a long time horizon may be able to wait for stock prices to recover. However, a retiree who needs income immediately may be forced to sell investments when prices are down. Substantially reducing retirement assets and future income potential. A major market decline, Such as the one that occurred during 2008. Can seriously damage the retirement security of those near or in retirement.

For individual investors, mutual funds and ETFs offer access to professional management and portfolio diversification. Investors can select among stock funds (equity), bond (fixed-income) funds, and funds that invest in multiple asset classes (balanced funds and target date funds). Funds may specialize in small, medium or large companies—in particular industries or in country-specific companies.

Stock investments can be structured in many forms, such as pooled indexed funds, pooled managed funds, variable annuities. And individually chosen stocks. In pooled indexed funds, there is risk related to the performance of the stocks in the index. And other pooled funds and variable annuities, there is risk related to the manager’s choice of stocks. In single stocks, there is risk related to the specific organization as well as the market as a whole.

As this discussion makes evident, retirees have many choices. Many will need expertise in selecting options that fit well with known needs. When mutual funds are offered as options in employer-sponsored plans. The employer preselects and monitors the funds made available in the plan. But the employee or retiree is still responsible for reviewing the plan documents that explain the investment options and for choosing which funds are most appropriate for the person’s own retirement plan. Obtaining outside guidance from financial professionals may help with making these important decisions.

PREDICTABILITY

Individual stocks rise and fall based on the outlook for the stock market, the industry and the specific company. Individual stocks are more volatile than a diversified portfolio, making them much riskier.

Stock index funds are based on different indices and are diversified investments. But the indices followed are still exposed to overall stock market fluctuations up and down.

PRODUCTS

Financial professionals, whether human or digital (often called robo-advisors), offer retirees a way for someone else to make the investment decisions. Also, do-it-yourself investors can use discount brokerages or mutual fund companies directly to access market investments.

Variable annuities enable a person to make a long-term investment, with taxes deferred while the money stays in the account. These products may have other useful features too, such as allowing stock investments with a minimum floor guarantee. And offering the option to convert the account value to a retirement income stream. Other features may add significant cost, however.

Private equity and specialized investment funds allow for more specific investments but require substantial expertise to choose. They are generally more risky than broad market portfolios, with a potential for greater gains and bigger losses. And are suited only for those with investing expertise and higher incomes and wealth.

MANAGING THE RISK

Use diversification: Diversifying widely across investment classes. (e.g., stocks, bonds and cash) is an effective strategy for many financial market investors. The risks related to individual stocks can be reduced by holding a portfolio of 20 or more stocks in different industries. And balancing the amounts held to avoid a concentrated investment in any single stock. Such approaches help investors absorb possible losses on some of their investments.

Bond and fixed income investments can vary in value based on their bond rating and the shifts in interest rates. But most often such investments are less volatile than the stock market. These investments also provide income and can be used to diversify further from stock market risks.

Think long term: Because it may take many years to recover losses. Those near or in retirement will want to be especially careful to monitor their stock market exposure. One strategy proposed by some advisors is to develop income-generating plans. And to gradually reduce the exposure to the volatility of the stock market throughout retirement. Bond and fixed income investments are used as such income-generating investments.

Consider pooled approaches: Pooled investment vehicles are typically large investment funds built by aggregating relatively small investments from individuals into a large fund spread across many investments and managed by professionals. A variety of pooled investment “funds” exist, such as mutual funds, target-date funds, index funds and ETFs. Some target-date funds reduce the exposure to stocks. And increase the exposure to bond and fixed income investments as the participant ages. Each fund is different, and fund companies provide descriptions of each fund’s investment objectives, past returns, main holdings and fees.

Use a range of opportunities: Stock and bond funds offer opportunities to invest in both U.S. companies and international stocks. One can also invest in different sectors and even in socially responsible funds. Investing in different types of funds is another way to diversify.

Don’t forget fees: There is a wide variety of fees and expenses for investing in funds. Higher fees do not necessarily mean an investment will produce a higher return. Fees reduce the net return on investments and so need to be understood and monitored carefully. While an investor cannot control the returns on their investments. They can control the fees they agree to pay for investing. If funds are purchased through an investment professional, there may be additional fees for advice. Some employer-sponsored 401(k) and defined contribution plans have fees and expense charges. That are lower than those a person might encounter by investing their retirement savings elsewhere.

Caution: Investment strategies that include options or margin accounts increase risk beyond market risk. Including the potential for both gain and loss. Since a great deal of expertise is required for effective use of such investments. They are not recommended for most individual investors.

ADDITIONAL CONSIDERATIONS

Some financial products allow retirees to invest in stocks or bonds but also guarantee against loss of principal. However, fees and expenses on these products may be high.

Younger workers can generally afford to take more risks because they have more time to make up short-term losses. Can increase their saving rate, or could even postpone retirement if necessary. Older people, however, might want to allocate a decreasing proportion of their assets to the stock market over time. Because they have less time to make up for losses that might occur from stock investments. Then again, those retirees who are able to cover regular spending needs without selling stocks might decide to hold a greater proportion of stocks than those with less financial security.

Target date (or “lifecycle”) funds are diversified as well. And they gradually shift some of the invested assets out of stocks and into bonds even as the investor continues to hold the fund. This occurs as the fund approaches and, in some cases, passes its target date. The target date is usually included in the fund’s name and is the expected retirement date of the fund’s investors. The allocation to stocks for a given age group varies across different asset managers. As does the path to rebalancing away from a focus on growth (stocks) and toward a focus on income (bonds). Retirees who invest on their own and who don’t use target date funds can still achieve the same goal by slowly moving a percentage of their investments from stocks to bonds as they age.

Investing large amounts in any single stock increases risk. When significant personal assets are invested in the stock of the company for which the individual works. The risk of job loss is compounded by the possible loss of savings. If the company does poorly or goes out of business. Even if a company appears strong, it is safer to diversify those assets across an assortment of investments. For individuals who are given stock in their place of employment. It is particularly important to focus other investments on opportunities outside their company. This will help avoid overconcentration in the fortunes of that company.

EMPLOYER SOLVENCY: ISSUES WITH CERTAINTY OF INCOME

BACKGROUND

People think about defined benefit (or traditional pension) plan benefits as providing guaranteed payments. However, loss of current or future retirement benefits/funds can occur as follows:

Single employer defined benefit plan issues: Single employer plans generally cover only employees of the organization that sponsors the plan. Loss of current and/or future benefits can occur if:

- An employer decides to freeze plan benefits or terminate a pension plan, thereby impeding the ability of the individual to earn future benefits.

- An employer lays off employees, thereby impeding their ability to earn benefits or save for retirement.

- An employer goes out of business or declares bankruptcy, the pension plan is underfunded, and benefits already earned exceed what is guaranteed by the Pension Benefit Guaranty Corporation (PBGC).

- In the case of a state or local government plan, the plan is not covered by the PBGC. Although the benefits may be further protected by state and local statutes that disallow changes to be made, underfunding could impact retiree benefits or state taxpayers.

Multiemployer defined benefit plan issues: Multiemployer plans generally cover private-sector employees who are union members. Plan trustees sponsor the plan and contributions are negotiated between unions and an employer’s management. Loss of benefits can occur if:

- Plan trustees freeze plan benefits, thereby impeding the ability of participating employees to earn future benefits.

- Employees are laid off, thereby impeding their ability to earn additional benefits or save for retirement.

- An employer that participates in a multiemployer pension plan goes out of business or declares bankruptcy, the plan is underfunded, and benefits already earned exceed what is guaranteed by the PBGC.

- The PBGC program for multiemployer plans is at risk of not having sufficient funds to pay anticipated benefits, which could impact retiree benefits or federal taxpayers.

- The plan is underfunded, and in an effort to avoid running out of assets, benefits already earned are reduced but only to levels not less than the benefit levels guaranteed by the PBGC.

Defined contribution plan issues: Unlike defined benefit plans, defined contribution plans do not have benefit guarantees. Participants are at risk for decreases in the value of their assets held in the plans. Any assets invested in an employer’s company stock most likely will lose value if the employer’s business becomes stressed or insolvent. If a person is still working at the time of the employer’s financial struggle, the worker may experience not only loss of retirement plan assets but also loss of job and other benefits.

Annuity contract issues: Benefits may be reduced if an insurer that is providing annuities becomes insolvent and the state guaranty fund is insufficient to cover the full obligation.

PREDICTABILITY

Market measures do exist for assessing risk of insolvency. For an employer sponsoring a pension plan, the risk is reflected in the company’s credit rating in the bond market. For an insurance company, it is the company’s claim-paying ability rating. Those with top ratings are safest, but ratings sometimes fall rapidly when business conditions or information changes. Ratings are also limited by the depth of re- view performed by the agencies offering them.

MANAGING THE RISKS

Be familiar with defined benefit plan issues: Pension benefits provided by most private defined benefit pension plans are insured by the federal PBGC up to certain limits. (For 2019, the limits were a maximum single lifetime income benefit of $43,742.04 at age 60, increasing to $111,710.40 at age 70 for single-employer plans). This means some retirees’ benefits will be lower than expected if the retirees are in an underfunded defined benefit plan that terminates due to bankruptcy of the plan sponsor.

Consider defined contribution plan issues: Defined contribution plans have no guarantee mechanism and participants need to diversify their investments. If a participant’s defined contribution account, such as a 401(k), includes a heavy concentration in employer stock, the participant would be wise to look to reduce their exposure in the plan.

Understand annuity contracts: Annuitants’ insurance companies are covered by state insurance company guaranty funds up to specified limits in the event of insurer insolvency. State guaranty limits vary by state but are generally $250,000 or less in present value of an annuity. An individual may wish to limit the amount purchased from one insurance carrier to the guaranteed amount.

ADDITIONAL CONSIDERATIONS

In defined benefit plans, there may be a choice of distribution options, such as lump-sum distribution, single-life annuity, and joint-and-survivor annuity. Retirees may want to consider the ongoing viability of the employer and the plan when deciding on the distribution option to choose.

A plan sponsor may also offer an option for retirees to exchange their guaranteed lifetime income for a lump sum payment. Retirees will need to consider whether they can manage the money for the remainder of their lifetime and produce sufficient income to satisfy their living standard. The decision to take the lump sum will be irrevocable and may increase the risk of running out of money in retirement. Those who are uncertain about what option to select would benefit from seeking advice to help them better understand their choices and risks.

With an insurance company annuity, it is important to understand the features, the costs of the features, the financial status of the insurance company, and the state insurance guarantee rules backing the insurance company’s annuity promises.

Personal Planning Considerations

LONGEVITY: POTENTIAL OF LIVING LONGER THAN EXPECTED

BACKGROUND

Managing one’s own retirement funds over a lifetime has many pitfalls, even with expert help. Nobody knows how long they will live or how long their money must last.

Life expectancy at retirement is an average, with some retirees living longer and a few who live past 100. For couples or partners, the funds must last to support them both while alive and continue through the lifetime of the survivor. In addition, longevity has increased over time and could continue to improve, especially as we see increased efforts to maintain one’s health and new breakthroughs in the field of medicine.

Risk lies in assuming that a retiree will live only to a certain age. Planning to live to the average life expectancy for someone at that certain age will generally be inadequate for about half of retirees in that age category because people don’t all die after a set number of years. Still, many retirees want to make sure their money will last a lifetime without cutting back on expenditures and without reducing their standard of living. In practice, unexpected events may make such a goal very difficult.

In addition, the longer people live, the more likely they are to face other risks, like the risk of inflation, increased health care needs, and/or some degree of cognitive impairment.

PREDICTABILITY

While it is possible to predict life expectancy for a population overall, it is very difficult to predict expectancy for an individual. Generally, women live longer than men and wives outlive husbands.

To help understand the chance of living to specific ages, retirees can use the Actuaries Longevity Illustrator.

MANAGING THE RISK

Several types of strategies exist to help manage longevity risk. A financial planning process can help pick an appropriate mix of strategies. Here are some possibilities:

Focus on retirement resources that promise to pay an individual a specified amount for life: Examples include Social Security, traditional pensions and immediate payout annuities. The analysis could include whether the products will also pay income to the surviving spouse or other named survivor.

Explore deferred annuity products: These are annuities that do not provide immediate income but do provide income once a person reaches a certain age. (See the discussion about longevity insurance in the product box in this section.) Before the deferred annuity starts making payouts, the retiree would use retirement assets, such as funds in an IRA or a 401(k), for retirement income.

Note: A licensed insurer is the only entity outside the government that can contractually guarantee to pay lifetime income. However, purchasing life insurance or an annuity involves trade-offs; the household must use a lump sum of assets to purchase the income protection or income stream these products can provide.

Delaying Social Security: Those who delay the start of their Social Security benefits will increase the lifetime inflation-indexed benefit they receive. In addition, academic research has found that because of Social Security benefit rules, delaying Social Security often is the best strategy for a household seeking to increase annuity income. Individuals may withdraw from IRAs or 401(k) accounts early in retirement to cover expenses before Social Security benefits begin.

However, for those in poor health, who expect to die early, or who do not have a spouse that depends on their benefits, claiming Social Security benefits earlier may be the best. In addition, for those who need Social Security benefits to make ends meet, the priority will be on claiming those benefits to meet the need.

Maintain a process to provide regular withdrawals with a gradual drawdown of assets: While lifetime income is not guaranteed, this strategy improves the chance of having income longer. Some financial firms offer programs that provide regular withdrawals to assist with the gradual use of assets. With this strategy, the retiree retains control over the assets, which may be used to provide for uneven or unexpected expenses or to leave money to heirs.

Manage the required minimum distributions (RMDs), as defined by the Internal Revenue Service (IRS): The RMDs refer to distributions from IRA and 401(k) retirement savings plans. Beginning in 2020, the RMD rules define a required distribution after the age of 72, based on remaining life expectancy. However, if you turned 70 ½ in 2019 or earlier, then the new rule of age 72 does not apply and you are still required to take the required minimum distributions for 2019 and in future years. The RMDs can be a good rule of thumb for tapping retirement accounts.

Consider the home and the value it provides: Retired individuals with outstanding mortgages can effectively improve their monthly cash flow by replacing their conventional mortgage with a reverse mortgage, using the lump sum proceeds of the reverse mortgage to pay off the conventional mortgage. Or, if the conventional mortgage has only a few years left, a better strategy might be to pay off that loan and not take on additional mortgage debt. Fees and terms of reverse mortgages need careful evaluation.

PRODUCTS

Key features of several guaranteed income products:

- Deferred variable annuities and fixed indexed annuities can include guaranteed lifetime withdrawal benefits that guarantee the availability of annual withdrawals up to a specified amount, even after these withdrawals have exhausted the account value.

- Deferred variable annuities can also include guaranteed minimum income benefits that provide a floor for guaranteed lifetime income in the event that investment returns have been poor and the annuity would ordinarily provide a lower income.

- “Longevity insurance” is an annuity that guarantees a specified income amount but does not start paying benefits until an advanced age, such as 80 or 85. This niche product can be added to a managed payout plan to be part of a carefully designed financial plan.

- “Payout annuities,” also called immediate or income annuities, convert a lump sum into a guaranteed lifetime income stream that starts paying benefits immediately.

ADDITIONAL CONSIDERATIONS

Periodic review: While a financial projection goes a long way in helping to plan how to put retirement strategies together, actual experience will be different. All retirees need to periodically review their expected income needs and resources and adjust spending or strategies if necessary. Many people do this annually along with their tax planning.

Approach to annuitization: Experts disagree about how and when to “annuitize” (convert an account value into monthly income) . And whether annuitization is a good strategy. A general rule of thumb is to avoid annuitizing all of one’s assets. Especially since Social Security already provides a significant amount of annuity income to most retirees. However, retirees may want to consider including privately sold annuities in their overall retirement plan as well. If so, they will want to review the following considerations as part of the decision-making process.

- While the primary advantage of owning annuities is income guarantees without the need to manage the money for withdrawals. Disadvantages include losing control of assets, costs of annuity products, and inability to leave money to heirs.

- Annuities without inflation protection provide only partial protection against increases in the cost of living a long life.

- Annuities can also include survivor benefits that provide income to a surviving spouse or partner.

- An annuity that seems unattractive to buy at initial retirement may make sense later. Multiple annuity purchases can be made as finances permit and/or over time. This will help average out the interest rates inherent in the purchase prices. And spread the risk among different insurance companies.

Investments that incorporate annuities: An emerging choice in some retirement plans is selecting investment options that include various guaranteed withdrawals. The guarantees may vary, so it is important to understand what option is offered by the plan that is available.

Using reverse mortgages to create retirement income: . This type of mortgage uses home equity to produce income while the homeowner lives in the home. The mortgage proceeds can be paid out in a lump sum, as a monthly income. Or withdrawn as needed from a line of credit. The homeowner will still be required to maintain the property as well as pay for home insurance and property taxes. Reverse mortgages can help mitigate risk in some cases, but they may also increase risk in others. Care is needed in the use of these products, as they are complicated. See this HUD website for resources designed to help people manage this decision.

Annuities compared with reverse mortgages: These two strategies differ in an important way. When interest rates are higher, the retiree will receive higher monthly lifetime payments. When buying a fixed annuity, while a reverse mortgage purchased when rates are higher will result in lower monthly payments. Some experts suggest strategies that combine reverse mortgages with other investments to provide retirement income.

POST-RETIREMENT EMPLOYMENT: THE GRADUAL MOVE TO FULL RETIREMENT

BACKGROUND

There are a variety of reasons why working longer may be important for retirees. For businesses and for society at large. Some jobs make few physical demands and may even be done at home. Some organizations prefer to hire older workers because of their stability and life experience. As for retirees. Many want to supplement their income or health care insurance in retirement by working at a “bridge job” either part time or full time. It is important for many retirees to stay engaged in purposeful activity, while others continue working for economic reasons.

Retirees take a variety of routes to find work. Specialized organizations help match seniors with opportunities. Some employers rehire retirees or use people from a retiree pool. They (including the federal government) offer a formal “phased retirement” program where the retiree continues to work for the same employer but for fewer hours.

Some retirees start small businesses. Others find work through the “gig economy,” which relies on contract workers and freelancers. These individuals work on paid special projects; continue as independent consultants in their field of expertise, whether in photography, technology, writing, research, teaching or an assortment of other areas; or provide services, such as Uber and Airbnb.

Those who want to work longer may encounter challenges. Many organizations prefer not to hire older workers, for example. Success in the job market may call for technical skills that some retirees cannot easily gain or maintain. Training and retraining have become increasingly important for those who want to work at older ages. Specialized organizations such as retirementjobs.com provide support for finding paid work.

PREDICTABILITY

Employment prospects among retirees vary greatly because of demands for different skills. And this can change with health, family or economic conditions. The preferences of retirees also vary greatly.

Many retirees retire earlier than planned, often because of job loss, poor health or family needs.

MANAGING THE RISK

Maintain employment: In order to remain employed in older ages, retirees will benefit from maintaining and continuing to improve their expertise and technical skills. Continuing to enhance personal and professional networks and maintaining a healthy mental and physical presence are good strategies too.

Postpone retirement: Postponing retirement, if possible, may be the most powerful way for workers to improve their retirement security. This allows retirement resources to grow (e.g., savings, Social Security. And other retirement programs) while reducing the number of years in retirement that need to be covered by those resources.

Retire gradually: Retirement can be a transitional process. Retirees may be able to reduce hours worked at the current employer (perhaps through a formal phased retirement program). Some may retire and then be rehired as a consultant or in another role. And others may seek employment at a different firm or in a different field.

ADDITIONAL CONSIDERATIONS

Retirement planning generally does not rely heavily on income from post-retirement employment.

Many retirees welcome the chance to change careers and move into an area with fewer hours and often less pay. But with more job satisfaction because there are fewer demands on their time and energy. Medicare-eligible retirees may take a transitional or part-time job knowing that they will have health care coverage with Medicare. However, opportunities change over time and it may be difficult to find these types of jobs in tight employment markets.

Terminating employment before age 65 may make it difficult to find a source of affordable health insurance. Before a retiree is eligible for Medicare. The Consolidated Omnibus Budget Reconciliation Act (COBRA) is a health insurance program that allows. An eligible employee and their dependents the continued benefits of health insurance coverage in cases. Where employees lose their job or experience a reduction in work hours. However, COBRA health insurance coverage usually ends after 18 months (36 months if disabled). Currently, health insurance is also available through the Affordable Care Act exchanges. In addition, some professional associations offer health insurance programs for their members. With the member paying the full premium for the coverage. A caution about costs is that these options may cost more than prior coverage from an employer-based health plan.

CHANGES IN HOUSING AND SUPPORT NEEDS: SUITABILITY AND AFFORDABILITY

BACKGROUND

Housing choices are very important and have a big impact on people’s comfort and economic situation. For most elderly households, housing is the biggest element of cost; for many, it is their largest asset. Housing costs vary greatly with regard to how difficult it is to maintain residence in the home and what services are nearby. Most people prefer to stay in their homes, particularly if they have lived there for a long time, but it is not always possible. Housing choices determine spending level, access to transportation, social activities, family involvement, medical care and various types of help.

Some housing is effective in accommodating changing capabilities and needs, but other housing is not. Changes in health can be sudden, tied to an illness or accident. Or gradual, perhaps linked to a chronic disease or cognitive impairment. When physical or mental capabilities decline, multiple housing problems can and often do emerge. But if housing includes accessible features. Or can be retrofitted to have such features, this can allow some people to stay in place rather than move.

Couples have different issues from single persons. Usually one partner will help the other. This becomes more difficult, however, if the helping partner can no longer manage alone or with locally available help. The options available at that point will likely increase cost and may create emotional stress.

When help is needed beyond what one’s partner can provide, family is often the first place to which retirees turn. Neighbors and friends may also help, and helpers can be hired in many locations. Senior housing can combine housing and support. Options provide a range of services, including help with activities of daily living as well as ongoing health care. Housing that includes support services and/or long-term care can be quite costly. Some housing focuses on care for specific diseases or conditions (such as dementia).

But the preferred type of housing for an individual may not be available in the chosen geographic area or may have a long waiting list. The desired specialized housing or caregivers sometimes are not available when support, specialized health care or long-term care is needed, even for private-paying individuals. This creates difficult choices—either move or accept what is available.

PREDICTABILITY

Future changes are hard to predict because they vary with the complexity of the housing, its location, the availability of family support, and ability to function; for example, stairs may become a problem. Snow removal and yard care can also become problems, although they can generally be contracted out.

Individuals may want to review the market for, and availability of, support services in areas where they intend to live in retirement. The need to relocate again will be less likely in areas where more support is available and where housing does not have stairs, etc.

The likelihood of needing help rises substantially with age, but changes in individual cases often are hard to predict. Some studies project that 70% of individuals over age 65 will need some type of long-term support and services. Of people in the total population who need long-term care, only a relatively small percentage need such care for a long period.

MANAGING THE RISK

Make affordable choices: Housing is financed mainly from personal assets and current income. People nearing and in retirement will want to make sure that their housing choice is affordable. Retirement planning will typically allow for the possibility of significant increases later to cover different types of housing or upgrade expenses for the current house and to secure help to allow aging in the home. The plan needs to factor in housing costs, such as repairs (which are unpredictable) and taxes (which may increase). Special assessments in condos are also unpredictable and can be very large.

Since housing is the largest expense for many retirees, some will need to reduce expenses by downsizing, moving to a lower-cost area, or entering a type of shared housing arrangement. Complicating matters is that housing values are unpredictable, and it can take a long time to sell a house.

Consider a range of financial strategies: Depending on a retiree’s situation, paying off the mortgage and remaining debt-free may be a good strategy. For others, taking a reverse mortgage may be a good strategy. As indicated earlier, a reverse mortgage allows a homeowner to withdraw housing values while staying in the home, but at a cost. Experts disagree about whether it is important to pay off a mortgage at retirement; whether it is a good idea will depend on factors such as cost of the mortgage, investment alternatives, and liquidity of the retiree’s household. An option for some retirees is to secure a home equity loan; this can provide a large lump sum to cover an expensive repair that can be paid off throughout retirement.

Choose location well: It is a good idea for retirees to select an area where family may be nearby to assist, in-home care is available, or other care facilities exist. Other factors to consider include climate preference; access to good close-by health care facilities; and availability of favored activities, reliable transportation and social opportunities.

Understand the options: Many seniors enjoy availability of a wide variety of different housing options offering different costs, services, social environments, and levels of support. Some options include financing for future care. Some require up-front payments. It is wise to explore the range of options, what they offer, and associated costs and risks before settling on a strategy. The strategy may need to be updated as needs and family situations change.

Make timely decisions: Some options require the retiree to move in while still in good health. Some have waiting lists. It is easier for retirees to move when they have fewer limitations. Some people sell their homes and rent when they think they are near needing housing that includes support services. Part of understanding options is understanding when a decision will be needed when choosing a particular option.

Finance support when major help is needed: Support can be expensive when a retiree needs major help. Financing can come from savings, current income, selling a house, or long-term care insurance for those eligible for benefits. In addition, Medicaid and Medicare may help with some or limited expenses in certain cases. Medicaid is available only to those with very low assets and income.

Be smart about buying insurance: Insurance coverage for long-term care provides support for those with disabilities so severe that the person needs assistance with daily activities, such as bathing, dressing and eating. Some older policies pay benefits for nursing home care only or require a hospital stay prior to claiming eligibility; newer policies may not have these requirements. The cost of long-term care insurance is much lower if purchased at younger ages, well before anticipated need.

Understand public programs: Medicare provides only limited, short-term care benefits in certain circumstances; it does not provide care for the long term. It requires a hospital stay prior to payment of subacute benefits. Medicaid coverage varies by state. In general, state programs cover a large share of total nursing home costs and may cover assisted living and home health care benefits. Medicaid benefits are available only to people with very low income or no assets. To qualify for Medicaid, people must spend down their assets to specified levels within a defined period of time.

States vary in the assistance they offer. Individuals may wish to consider public programs and support in choosing where to live.

Medicare, Medicaid and/or long-term care insurance may help with some medical equipment expenses for use at home.

PRODUCTS

Reverse mortgages offer retirees a way to extract home value while living in the house. They can be used to finance improvements on a home or to help with a home purchase. The product can be set to produce monthly income, make payouts as need, or be paid in a lump sum. Costs and risks need careful investigation. The reverse mortgage debt is paid back upon sale of the home.

Home equity lines of credit or traditional mortgages can provide extra cash to help smooth payment for large expenses. However, the loans must be repaid from future income.

Senior housing options include independent living in 55+ communities, housing with support services with various levels of support. They vary greatly in cost, size, level of support offered, number of meals and housekeeping services, etc.

Continuing care retirement communities combine options at different levels of support and generally require entrance while still in good health. A range of contract types are available including some that provide for prepayment of future long-term care services.

ADDITIONAL CONSIDERATIONS

Choices depend on personal preference and limitations in functional status in addition to financial and family resources. The number of options available is much larger for individuals with greater financial resources. Care options are link to housing choices, and these are evolving.

When a retiree lives in a paid-for house rather than renting or making mortgage payments, monthly expenses may be considerably lower. However, maintenance, property taxes and homeowners’ insurance must still be paid, and these may increase over time. In addition, modifications to the home may be need to accommodate aging in the home as functional status changes. A home with equity can be use to produce cash in retirement by selling it or using a reverse mortgage.

As indicated earlier, whether to pay off or maintain a mortgage is an important financial decision for many families. Whether to keep the house or sell it is another big decision. In some cases, the homeowner may pay off a traditional mortgage by taking out a reverse mortgage.

Selling a current home can allow a retiree to downsize to a smaller or more manageable residence, move to a lower-cost area, reduce mortgage debt, and release cash from any increased home value.

Communities vary greatly in how “age-friendly” they are. Some areas require travel to access medical care. Rural areas often do not have trauma centers or medical specialists. If available in a community, senior “villages” offer valuable support to seniors. However, they vary in what services they offer.

“Continuing care retirement communities” include elements of advance funding of costs for long-term care and medical care. Arrangements vary greatly, and there can be considerable risk involve, including the risk that the facility may go bankrupt. Retirees will need to evaluate the community’s options, charges and financial stability very carefully.

Defining functional status can be a problem. For example, “difficulty in using telephone” might mean the person:

- Can’t use a phone at all.

- Can answer a call but not place one.

- Can’t look up a number to call but can use speed dial.

- Can use a phone on limited basis but cannot use an answering machine or a cell phone.

Phone call factoid: None of the limitations on using the phone would trigger benefit eligibility under long-term care insurance. But they may trigger the need for help.

Spousal protection rules (which vary by state) need to be consider when deciding whether Medicaid would help. Medicaid programs are cutting benefits in response to state budget cuts.

Combination and linked benefit products may provide part of the financial plan for care. These products combine long- term care benefits with annuities or life insurance. They are available in most areas and offer alternatives to purchase of stand-alone long-term care insurance.

Some cautionary notes: Lack of appropriate facilities or caregivers may force people into a higher level of care or cause them to be without needed care. The current shortage of health care and long-term care workers may get worse as the population in need of care increases.

CHANGE IN MARITAL OR PARTNERSHIP STATUS: DEATH OF SPOUSE OR PARTNER

BACKGROUND

Society of Actuaries research indicates that some retirees expect to be worse off financially after the death of a spouse or partner. Others about the same, and others better off. There is a wide variation in situations.

The death of a spouse or partner is a major change that can be accompanied by a decline in economic status and a variety of challenges:

- Some income—such as Social Security benefits or traditional pension benefits. May stop upon death of a current or former spouse or partner.

- The death of a caregiver spouse or partner may bring financial problems to the surviving spouse or partner with disabilities.

- The surviving spouse or partner may not be able or willing to manage the finances.

- Couples frequently help each other, so when the partner support is no longer there. The survivor suffers not only grief over loss of the loved one but also over loss of trusted and continuous support.

Challenges in coping with a spouse’s or partner’s death or terminal illness may contribute to increased rates of loneliness. Depression and suicide among the elderly.

On the other hand, the survivor who was a caregiver for a long period may find daily life to be less difficult in some cases once the loved one has died. In addition, the assets needed to support two people will now need to support only one person. Although the expenses may be more than half of what they were for the couple.

Society of Actuaries research indicates that adult children provide both financial and nonfinancial assistance to parents who need help. Adult children are more likely to provide nonfinancial help for parents as their parents develop limitations. The loss of a spouse increases the likelihood that the surviving spouse will need additional help. Widows in particular seem to need more help than others. Widows without children still need support but may not have family to aid them.

PREDICTABILITY

Overall, women are widowed more often than men and women generally live longer than men. Since many couples consist of an older husband and younger wife, long periods of widowhood are not uncommon. In individual cases, it is very difficult to predict which spouse or partner will live longer. In some cases, death is expect due to the progress of an illness, but in others, it is unpredictable.

MANAGING THE RISK

Financial approaches: Many financial vehicles are available and can be used in combination. These include:

- Life insurance

- Survivor income in Social Security, traditional pension plans and annuities

- Long-term care insurance

- Savings and investments

Legal matters, trust funds and beneficiary designations: A well-structured retirement plan can be an important source of stability for the surviving spouse or partner. Wills and estate planning are important tools to provide for a surviving spouse or partner. It is important to be sure to keep beneficiary designations up-to-date. Trust approaches are very valuable in some situations.

Family and community support: Adult family members and friends may step in to help with adjusting to the new circumstances. Making changes, managing finances, assessing choices or providing care.

Plan wisely for Social Security survivor benefits: Married couples may want to choose their Social Security retirement dates carefully to increase potential survivor benefits. Many options exist, but one option is that the lower earner applies for benefits as early as age 62 and the higher earner waits until age 70. The best approach varies by situation. Social Security eligibility for domestic partners is complicate and can vary by state of residence. The general rule for Social Security benefits is that benefits will be paid out to spouses. And surviving spouses based on the legality of the marriage in the state of residence. So if a partnership is consider a legal marriage in the state in which a couple lives. Both partners would be eligible for a spousal and surviving spouse benefit.

Purchase of annuities: Where one spouse or partner managed the finances and the other has limited capability. Buying an annuity for the limited-capability spouse or partner is a way to protect the person from needing to manage the funds. However, trade-offs are involve, and retaining some assets to pay for emergencies is important as well.

ADDITIONAL CONSIDERATIONS

Some experts say that a survivor needs about 65%–75% of the couple’s income to maintain the couple’s living standards. Widows’ financial resources are very low in many cases.

Blended families are becoming increasingly commonplace. Families are recognize as important. But we do not know if family members in blended families help in the same way that they do in first-marriage families.

Survivors will want to review beneficiary designations, account registrations. Trusts, wills and power of attorney documents after a death of a spouse.

Heads up for single- and dual-earner families: Social Security provides continued benefits to survivors based on their employment histories and family status. A single-earner family survivor generally gets two-thirds of the combined family benefit that was payable while both were alive. However, in a dual-earner family with equal earnings, the survivor gets only about half of the combined benefit. In this case and many others, the reduction in Social Security benefits after the death of the first spouse is much greater for the two-earner couple than for the single-earner couple.

People who are eligible to receive Social Security benefits as a widow or widower are not eligible for those benefits if they remarry before age 60.

CHANGE IN MARITAL OR PARTNERSHIP STATUS: DIVORCE OR SEPARATION IN RETIREMENT – | Secure Retirement |

BACKGROUND

Divorce can create major financial problems for either or both parties. It generally leads to splitting of assets. It costs more to maintain two separate households than a joint household.

Marriage and divorce can affect benefit entitlement under public and private pension plans and Social Security. Some of these effects may not be well understood.

Society of Actuaries research indicates that divorce after retirement is one of the post-retirement shocks that individuals do not recover from well.

PREDICTABILITY

A substantial percentage of marriages end in divorce. Many women are in single households later in retirement. Men are more likely than women to remarry after being widowed or divorced.

MANAGING THE RISK

While this is a personal issue, retirees need to engage professionals that can assist them in knowing their rights. And assessing the value of assets and income they may receive from divorce proceedings. Attorneys, accountants and financial planners exist who specialize in divorce law and financing.

At divorce, the law allows for a split of private pension plan benefits covered by ERISA. For this purpose, divorcing spouses need a properly drafted legal document: a qualified domestic relations order (QDRO).

Social Security pays benefits, similar to spousal benefits, to a former spouse after divorce if the couple was married for 10 years or more. However, divorced spouse’s benefits generally end upon remarriage.

Older couples who marry, especially those with children. May want to establish a prenuptial agreement that defines each party’s rights to distribute or dispose of property as they wish, not as a court would decree, in event of divorce.

ADDITIONAL CONSIDERATIONS

In divorce proceedings, retirement benefits may get transfer from one spouse to the other. Depending on decisions of the parties and the divorce court. Often the residence is one of the largest investments in the financial portfolio. And is retain by one spouse in exchange for pension rights or other invested assets. However, this may not be the best option for a retiree who is unable to maintain the ongoing expenses. Maintenance and lifestyle of the house.

It is very important for divorcees to review and update beneficiary designations. Account registrations, trusts, wills and power of attorney documents after a divorce. Should remarriage occur. The new partners will want to make a similar review in light of their newly joined finances and relationships.

Couples with previous marriages who are considering whether to marry again will also need to study. How their decision will affect their benefits from Social Security, Medicare, Medicaid and retirement or survivor programs.

At marriage, an individual’s rights to current survivor’s benefits under Social Security and retirement programs may change. This is a matter for careful consideration.

Unexpected (or Unpredictable) Events

PUBLIC POLICY CHANGES

BACKGROUND

Policy risks include these possible developments:

- Fluctuations in interest rates driven by monetary policy, such as current historically low rates or higher rates in previous periods.

- Increase in taxes (income, property, sales, etc.) or new types of taxes (consumption, value-added, etc.). New kinds of taxes or further changes in tax law could reduce the tax advantages in retirement plans.

- Reduction in benefits from public programs, including Social Security, Medicare and Medicaid.

- Increase in retiree contributions for Medicare and Social Security. Higher- income retirees are already affect by an income-related increase in Medicare premiums and a Medicare tax on unearned income.

- Tighter income standards for Medicaid and other means-tested programs.

- Major changes in availability and financing of health care. Some groups strongly advocate repeal or major changes to the Affordable Care Act (ACA). Others advocate a move to single-payer coverage or extending Medicare. The outlook for health care coverage changes with each election. This makes it unclear whether coverage might be extend to the uninsure or whether there will be increases in the number of uninsure, what the future of ACA marketplaces and government subsidies will be, and the extent of future consumer protections.

- Changes to long-term care financing.

PREDICTABILITY

Public policy changes may include benefit cuts and/or higher taxes to pay benefits to aging baby boomers. This may affect Social Security, Medicare and veterans’ benefits. Given solvency concerns over the next decade for both Social Security and Medicare, it is likely that either benefit program will be reduce or experience some sort of tax increase levy (general or specific to beneficiaries).

For example, the Tax Cut and Jobs Act of 2017 impacted residents in high-tax states by limiting itemized deductions and making other changes. However, this tax law create an unfunded $1.3 trillion deficit, adding to the uncertainty over whether it would be amended. This made tax planning over the following two- to three-year time horizon extremely difficult.

MANAGING THE RISK – | Secure Retirement |

Maintain an emergency fund: Having savings for emergencies helps protect against all risks.

Use tax-favored investments: Municipal bonds, Roth IRAs and Roth 401(k)s have a tax-favored status that offers protection against future higher income tax rates.

Convert to Roth programs: Converting a traditional IRA to a Roth IRA can provide tax free growth on Roth IRA assets and tax free withdrawals from a Roth IRA in retirement. In addition, Roth IRAs do not require a person to take any required minimum distributions (RMDS). However, careful consideration must be given to the immediate and long-term tax implications for converting a traditional IRA to a Roth IRA.

Use required minimum distributions (RMDs) to make charitable contributions: Current law allows a taxpayer receiving RMDs to make a Qualified Charitable Donation (QCD) by directly transferring up to $100,000 of funds from their IRA custodian to a qualified charitable organization. Amounts distributed as a QCD can then be counted toward satisfying their RMD for the year and can also be excluded from their taxable income.

ADDITIONAL CONSIDERATIONS

Historically, Congress has been very reluctant to reduce benefits promised to current retirees. Older workers also may escape benefit reductions, but young workers’ future government benefits are less safe from reduction.

Under current law, more and more retirees will pay income tax on their Social Security benefits and taxes or higher premiums and copayments to help fund Medicare.

Congress continues to debate how to change the ACA, the health care reform law enacted in 2010. This increases the level of uncertainty in current planning.

Future reductions in Medicaid programs and in support for long-term care also seem likely and can reduce the supply of quality providers and facilities in total, affecting both individuals on Medicaid and the broader population.

SIGNIFICANT HEALTH CARE NEEDS

BACKGROUND

Unexpected health care costs are a major concern. Employers continue to cut back on post-retirement health care benefits. Low-income retirees may spend a large percentage of their resources on health care, although Medicaid does provide assistance to them. Medicare generally does not cover certain costs, such as dental, vision, hearing and most long-term care. Prescription drugs are covered only if Part D is elected. Medicare does not cover out-of-country care and care provided by medical professionals who do not contract with Medicare.

Medical technology improvements that extend life may increase health care costs.

Uncertainty over the future of health care regulation and financing is hampering current retirement planning.

Out-of-pocket expenses may increase in the future if Medicare reduces what it covers, and more doctors may choose not to contract with Medicare.

At one time, many larger employers provided coverage to supplement Medicare and offered retirees and family members continued coverage in their programs until Medicare eligibility. These benefits are becoming increasingly rare.

PREDICTABILITY

Health care costs are:

- Relatively easy to predict for a large group over a limited time period.

- Hard to predict for individuals, but for those with certain chronic diseases, such costs are more likely to be higher than average.

- Very hard to predict far into the future.

Future resource requirements are hard to predict because a high level of uncertainty exists about the future design of Medicare and other changes in health policy and operation of health care exchanges.

MANAGING THE RISK

Make Medicare choices wisely: Medicare is the primary source of coverage for post-65 retirees. Supplemental coverage is available from employer plans, individual Medigap policies, and Medicare Advantage (MA) plans. Because MA plans typically include supplemental coverage and often drug coverage as well, these may be a way to stretch one’s dollar versus Original Medicare, where most people choose to buy supplemental and Part D drug coverage in addition to Medicare to cover those expenses. Some MA plans are zero-premium, meaning there is no additional cost. However, those in MA plans do not have as wide an array of choices of providers, and some have very limited choices. Dental, vision and hearing coverage is also available within many MA plans and on a stand-alone basis as well.

Explore availability of other public support: Other federal or state-local programs may assist low-income retirees.

Utilize Health Savings Accounts (HSAs): Health Savings Accounts can be used while working to accumulate money to help pay medical costs in retirement. In any case, it is desirable to have savings for unknowns.

Consider health care in retirement timing: Instead of retiring from a job with health benefits, employees may choose to keep working, at least part-time, in a job that will allow them to remain covered.

Make good lifestyle choices: Some retirees may be able to reduce their risk of major health problems by lifestyle changes involving diet, exercise, smoking, etc.

Consider options for early retirees: Individual health coverage is currently available through marketplaces under the ACA, but the choices are limited in some states and premiums are both rising and more volatile from year to year.

Take advantage of employer offerings: A few retirees have access to coverage from their former employers. In such cases, it pays to explore what the former employer offers, including COBRA, and whether it is a good deal.

Look into discount programs: Some “discount benefit plans” are available for typical noncover services, such as dental or vision care. Regulators have had to monitor and prohibit marketing practices to protect consumers from mistaking such discount arrangements for insurance coverage.

Buy coverage for travel: Traveling for pleasure or to second homes requires careful consideration of how medical care needs will be cover by insurance or Medicare and Medigap. Heath care networks may not be available as required by current coverage for routine needs. Emergency care may be available only for limited purposes. Special insurance for travel away from a retiree’s home area can be purchase on a trip or annual basis.

Obtain care out of the country: Medical travel or even migration to other countries has gained popularity as a way for consumers to reduce their cost for care. Costly surgery cover in the United States by normal insurance sometimes is available elsewhere at lower out-of-pocket cost, although there may be added risk. Some people travel out of the country for major dental care. Quality of medical procedures outside the United States needs careful scrutiny, along with evaluation of travel costs, related accommodations and necessary services. Medicare does not cover out of the country care. Other U.S. insurance coverage may also not cover such care.

ADDITIONAL CONSIDERATIONS

Medicare Part B and D premiums vary by income, and Part B and D premiums and deductibles plus premiums for a Medicare supplemental plan can be substantial and a surprise to many people.

Medicare in the U.S. pays a significant portion of the costs for acute medical care for covered persons provided they have Parts A and B. Part D is additional and covers prescription drugs, but there can be significant copayments, particularly for people with high drug costs.

Dental, hearing and vision are not cover by traditional Medicare. Medicare currently covers only very limited parts of long-term care. Medicare payments for limited home health care and a short period of skilled nursing care after hospitalization may be available.

Insurance does not cover all medical costs. Retirees still pay for deductibles, copays, out-of-network services and procedures or prescriptions excluded from their insurance programs. In addition, travel for health care is generally paid by the retiree.

UNFORESEEN NEEDS OF FAMILY MEMBERS

BACKGROUND

Many retirees find themselves helping other family members, including parents, children and grandchildren. Retirement planning recognizes the possibility of future assistance to such family members. A change in health, employment or marital status of an adult child may upset their financial situation. It is common for adult children to seek greater personal or financial support from the retiree.

Older family members frequently receive assistance from adult children when their capabilities change and they need help. The elders are much more likely to receive help with tasks such as driving, shopping, household management, managing medical care, etc., rather than financial support.

PREDICTABILITY

Children or grandchildren often need money for higher education, and a few need special help to deal with physical or mental handicaps. Their parents and grandparents can usually foresee such cases by the time they retire and try to plan accordingly.

Adult children may look for help in case of unemployment, divorce or financial setback. This is more difficult to predict. Adult disabled children may need ongoing help.

MANAGING THE RISK

Plan for support of other family members: Some family situations (loss of job or health, divorce, etc.) arise for which a retiree may want to provide financial support to the family member. Such support may be one-time, temporary or ongoing. When planning for retirement, the retirees would be prudent to consider the potential of such family needs and consider whether they can actually provide support—and to do this before committing their assets to the family.

Give gifts to family, charity or other causes: In some situations, retirees want to provide significant gifts to family, a favorite charity or other causes. However, such asset transfers must be done carefully to ensure the retirees do not subject themselves to an unwanted reduce standard of living or to poverty later in life.

Consider public benefits: Social Security may pay benefits to children and surviving spouses after the death of a parent or a spouse.

Communicate well: Good, open communication among family members about financial resources and expectations can help minimize conflicts in the future and open the road to better management when help is need.

ADDITIONAL CONSIDERATIONS

An increasing number of today’s grandparents are responsible for, and are the primary caregivers for, their grandchildren.

Blended families resulting from remarriages can also expand the potential number of family members to support and complicate relationships, roles and responsibilities.

Family members, status and relationships can change during retirement. Such changes can affect the assistance available to a retiree.

BAD ADVICE, FRAUD OR THEFT

BACKGROUND

Retirees may lack financial skills and judgment, especially at advanced ages as mental capabilities decline. They may be prey upon because of their retirement savings and fading cognitive skills.

Friends and relatives may be unqualified to provide advice. Brokers may promote unsuitable or expensive products. Family members or caregivers who gain control can have selfish motives. Professional con artists promote investment schemes that are too good to be true.

Caregivers, advisors or scammers may have access to a retiree’s assets, personal belongings, ID data, passwords and other personal information.

Banks’ automatic payment plans and overdraft protection may pave the way for fraud through third-party access to bank account information.

Retirees wanting higher returns may be led to accept bad financial advice or to invest in riskier investments that in hindsight proved to be unsound.

PREDICTABILITY

Exposure to bad advice or fraud may increase as retirees directly control more assets, financial products become more complex, more retirees use computers, and scammers become more adept.

However, good advice and good products are increasingly available to people who seek them out.

MANAGING THE RISK

Use prudent practices: Retirees can take precautions to manage this risk. Some examples follow:

- Brush up on the basics of investing and handling money.

- Get advice from qualified and trustworthy sources, including federal and state agencies and employer-sponsored programs.

- Simplify finances to allow for clearer decision-making and fewer mistakes. Simplification will also provide a better approach for the person handling financial and related affairs once the retiree is no longer capable of doing so.

- Get several opinions on important issues, and don’t fall for pressure tactics.

- Be very cautious in giving control of assets (e.g., bank accounts, home equity and personal data) to any professional or in dealing with strangers personally or online.

- In later years, expect to rely more on trusted family members or professionals. Try to investigate and choose who this will be long before their help is need. Family members and professionals can be a source of exploitation of the elderly.

- Use paid caregivers who are bonded and insured.